For the best experience, please download the PDF version via the Download button and print the PDF file.

AST SpaceMobile

Research Report

NOTE: If you are online, we recommend viewing the interactive version of this report instead. It has videos, dark mode, interactive valuation model and other extra features missing in the PDF version.

Disclaimer: This report is made available for purely informational purposes only. Transhumanica Research Ltd’s (“Transhumanica”) publishing of this report does not constitute in any way, whether explicitly or implicitly, any provision of services or products by Transhumanica. Nothing contained in this report constitutes advice or a recommendation to buy or sell any securities or implement any investment strategy, and investors should decide for themselves which such products are suitable for them or seek professional advice tailored to their particular situation.

All statements in this report represent strictly the beliefs, assumptions, expectations, and evaluations of Transhumanica at the time of writing, which may change over time without notice. Forward-looking statements involve known and unknown risks and uncertainties that could cause actual events and states of affairs to be materially different from those expressed or implied by such statements. Transhumanica does not guarantee the accuracy of any information contained in this report nor the reliability of any external sources referred to.

Transhumanica is an independent firm and has not received any compensation for producing or publishing this report.

This report is provided free of charge, and its distribution for a financial compensation is strictly forbidden.

All images are used under fair-use policy with sources acknowledged.

Disclosure: Individuals and entities related to Transhumanica hold a long position in AST SpaceMobile common stock, warrants, and/or call options at the time of this writing.

Contact: You can contact us at feedback@transhumanica.com.

ASTS stock might go to $500:

SpaceMobile plans to turn every phone into a satellite phone and bring up to 3.2 billion people online for the first time

Highlights

AST SpaceMobile (ticker: ASTS) will turn every smartphone into a satellite phone with broadband internet access anywhere in the world

It will achieve this by deploying and operating satellite “cell towers” in orbit that will cover the whole planet with LTE/4G/5G signal

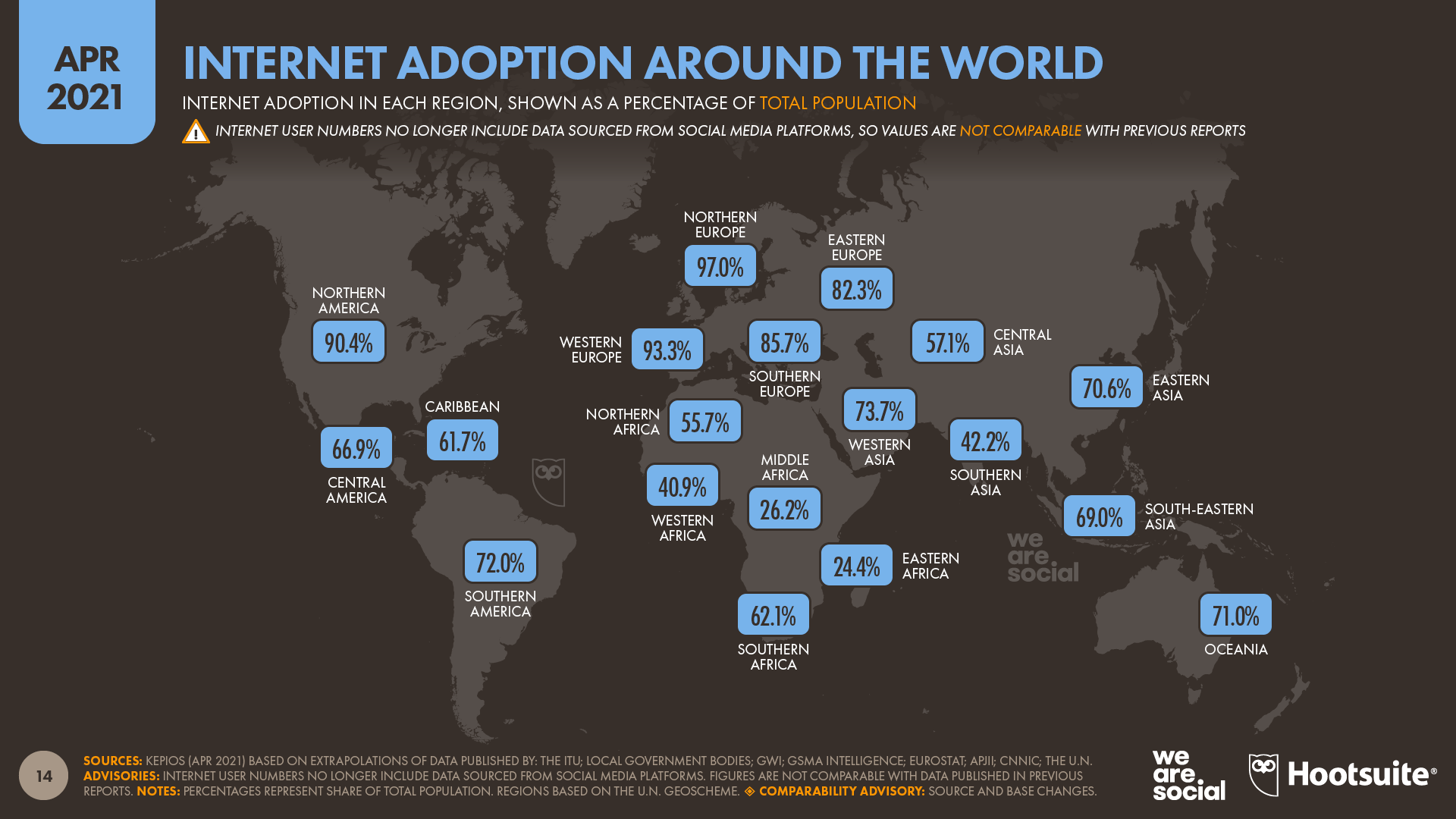

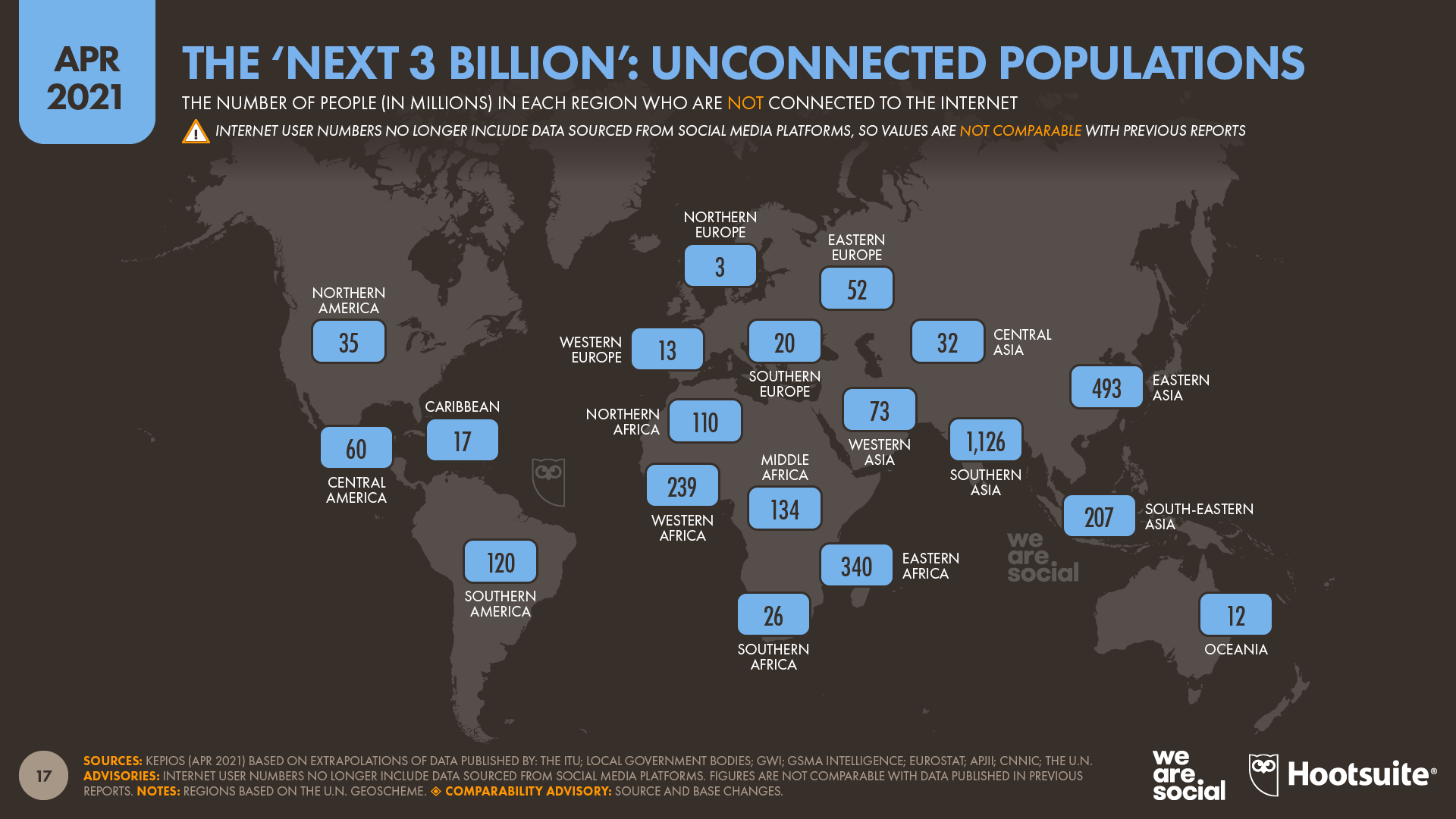

3.2 billion people are currently offline with no internet access [1,2]. The pro-social and economic impact of bringing these people online can’t be overstated

1 trillion USD addressable market undergoing rapid growth in the sectors targeted by SpaceMobile: There will be more than 400 million new mobile phone users by 2025. Four in five connections globally will be smartphones by 2025; smartphone connections in Sub-Saharan Africa will nearly double. Global mobile data usage will grow almost fourfold by 2025. [1]

AST has a head start over competition. Other satellite internet providers usually require expensive satellite phones and offer very limited data - e.g. Iridium - or they require satellite dishes – e.g. SpaceX's Starlink broadband internet. The most viable competing service was announced only recently on August 25, 2022 - a partnership between T-Mobile and Starlink [3], which validates what AST is doing (more on this in the Competition chapter). The second closest competitor is a private company called Lynk, which is commercially behind SpaceMobile. Lynk's service will initially focus on low data rate services - text messaging only [4]).

Patented (2,400+ patents & patent claims [5,6,7,8] and to an extent tested [9] technology (space to Earth communication)

Funded for a commercial launch

Partnered with Vodafone [10] for immediate access to 271 million unconnected people, as well as additional agreements with major mobile network operators who together have 1.8 billion mobile customers [11]

50/50 revenue sharing business model with mobile network operators leads to extremely attractive 90%+ profit margins, as AST will be selling its services wholesale only and most of the administrative, sales, advertising and related expenses will be on the side of operators

Commercial viability validated by enterprise partners and investors, including Vodafone, Rakuten, American Tower [12], AT&T [13], Telefonica, Nokia [14], TSMC [15] and more

Explosive stock price growth potential (>$500 share price 2030 target in case the company succeeds in its mission, a 50x return from $10 price)

Keep in mind that in case the company doesn't succeed in its mission due to technological, regulatory, execution, financial, competition or other risks, the stock can go to $0 and become entirely worthless.

What follows is a 2-page summary, followed by the actual report. Enjoy!

Current ASTS price and chart courtesy of TradingView:

The problem: 41% of humanity is offline

Over a decade ago, internet access got established as a fundamental human right. However, 3.2 billion people remain offline. [1,2] Cellular dead zones plague the world, and 6% of global population doesn't even have cellular coverage.

Imagine how your life would be different without internet: no email, no Google, no YouTube, no Wikipedia, no social media, no chat apps. That's the reality for billions. And 6% of people [1] have it even worse - not just no internet access, but also no cellular coverage. Even calls with family or to emergency services can't be taken for granted by everyone, or everywhere.

Based on the current rate of the internet coverage expansion projected by the United Nations, the goal of getting 90% of the world’s population online won’t be achieved before 2050. [16]

Without aggressive innovation, meeting this target will take even longer. High initial costs of cell towers dramatically slow down connectivity expansion in the developing world. In the poorest nations, an internet connection is unaffordable for most. This won’t change as long as the necessary infrastructure remains expensive.

Countless people have died because they had no cellular connectivity to call for help.

Lack of connection with the outside world dramatically adds to the monetary misfortune of the world’s poorest, closing doors to potential opportunities for lifting themselves out of poverty.

This is also bad for human civilization as a whole. Many geniuses came from impoverished backgrounds. There are currently hundreds of millions of children, many of them undoubtedly gifted - potential next Einsteins and Newtons and Elon Musks - with no internet access. Just imagine all their contributions if they were able to join the global academic and business community. There are historical cases of people with no formal training making substantial contributions to science, such as the fascinating story of Srinivasa Ramanujan [17].

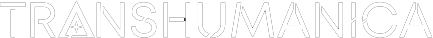

The following map shows how AST SpaceMobile plans to provide coverage in three phases:

The solution: turn all phones into satellite phones

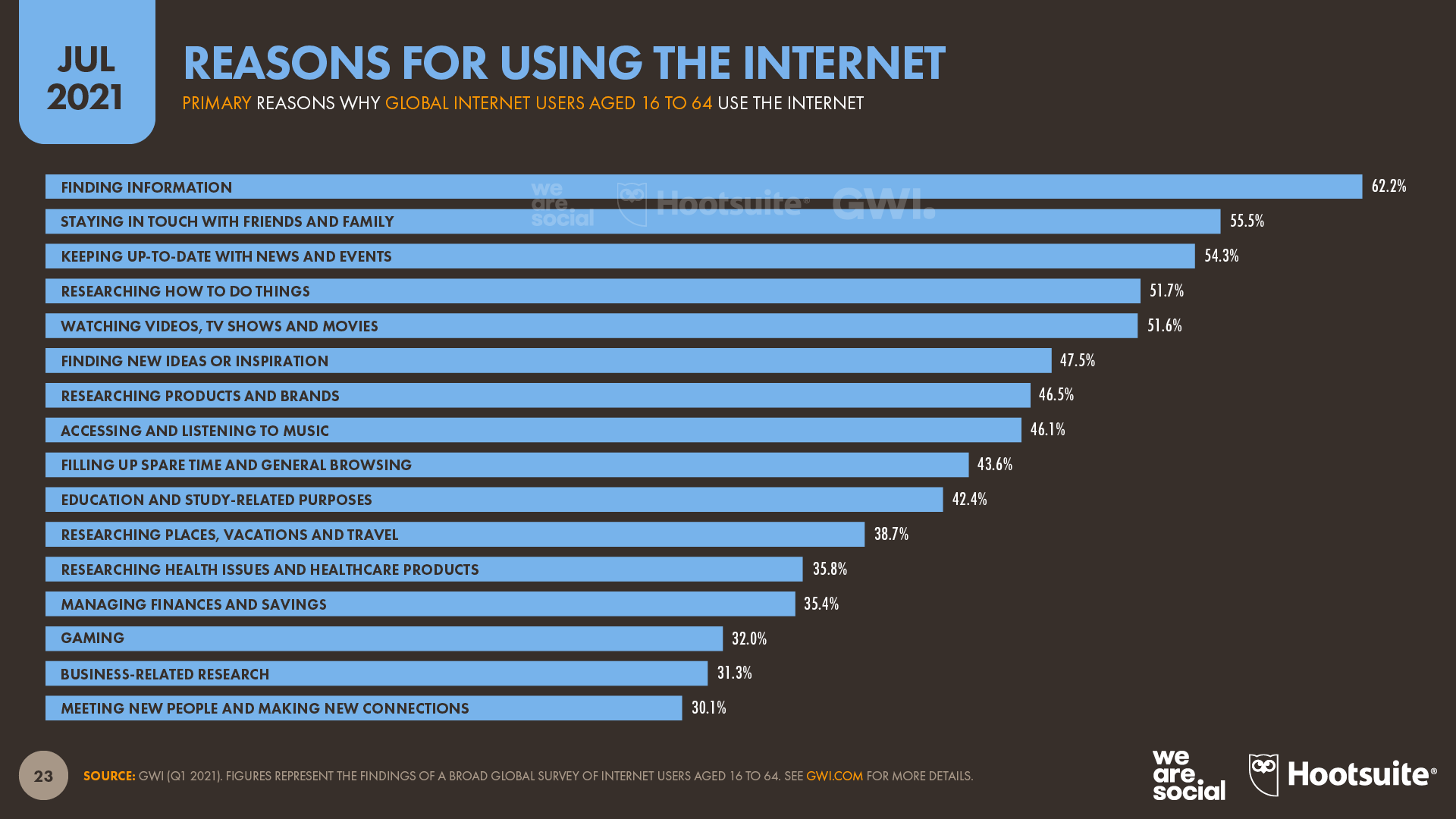

Cellular coverage and internet access go hand in hand. 92.8% of internet users use mobile devices to go online most of the time. There are 5.27 billion unique mobile users, increasing each year rapidly. [18]

Today, only about 25 percent of the world’s landmass is served by cell towers, the rest has no coverage [19]. Traditional terrestrial tower networks will never reach full global coverage, as there are no economic incentives to expand into low population density and low-income areas. For a solution, we must look to the sky.

Satellite constellations are magic made real. They provide robust wireless networks with global coverage at a fraction of the cost of traditional terrestrial towers. The satellites can easily cover the whole planet, including the most impoverished regions. The services can then be priced accordingly in each region to be affordable by locals.

Many understand the gravity of the global connectivity problem and the economic opportunity that it presents. Recent technology advancements and the rapid decrease of payload to orbit costs started a commercial space race. Starlink from Elon Musk’s SpaceX and Project Kupier from Amazon are some of the most prominent players.

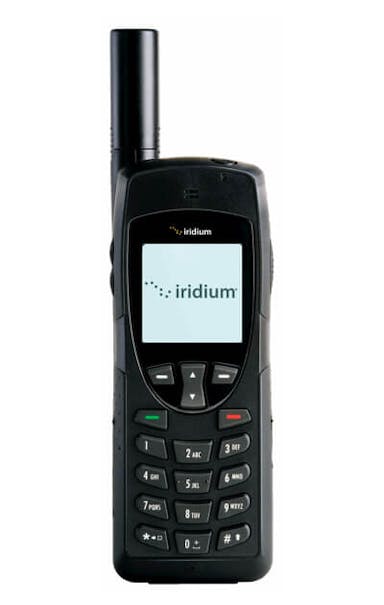

However, even the most advanced satellite constellations are of no benefit to those who can’t afford their services. Nearly all existing services require customers to purchase expensive hardware such as satellite phones (>$1,000 for Iridium sat phone) or mounted terminals with powered antennas ($599 for a Starlink terminal [20]).

For this reason, a space-based cellular broadband network which works with regular phones that people already own is the holy grail.

The opportunity: it’s still early for AST SpaceMobile stock

Until recently, the technology of direct satellite to unmodified mobile phone communication has been the stuff of imagination. AST SpaceMobile (ticker: ASTS) is now making it a reality.

AST SpaceMobile has the first-mover advantage, nearly $500M funding, unique product, over 2400 patent claims [5] and exclusive commercial agreements with Vodafone/Rakuten/AT&T [21] and other big players which allows it to target billions of customers almost instantly once their satellites get deployed.

It already proved their solution works by establishing space communication with their prototype satellite.

This in-depth report will analyze the AST SpaceMobile ($ASTS [22]) stock as an investment.

We believe that if the company succeeds in its mission, it could bring shareholders eye-popping returns by 2030, e.g. as much as 50x~ from a $10± entry price. This report explains how.

At Transhumanica Research, we focus precisely on opportunities like this: high pro-social returns for humanity and high potential financial rewards for visionary investors in our community.

We believe that ASTS has all the ingredients necessary to become a “cult stock”.

SpaceMobile introduction

AST SpaceMobile is a company that plans to launch a constellation of satellites to space to provide global mobile phone signal coverage (LTE/4G and 5G) over the entire planet. The satellites will work with ordinary phones that everyone already has in their pockets, without any modifications necessary [23,24]. No external antennas are needed. AST satellites will operate on the LTE spectrum authorized to AST’s partner carriers via a licensing lease.

Even a cheap $5 refurbished phone used in rural Africa will be able to connect without any modifications [25]. SpaceMobile will provide connectivity to billions of people, whom will move from having no connectivity to suddenly having Netflix streamed to their cellphones [25].

The satellites act as a relay (repeater) between the phones and existing antennas on the ground that are connected to the cellular network [26].

SpaceMobile will also support NB-IoT (Narrowband-Internet of Things) devices [27]. The global IoT market was worth $760 billion in 2020, and is expected to grow by 10.5% every year up to $1.39 trillion in 2026 [28]. This represents a huge opportunity, since the 50/50 revenue-sharing business model that SpaceMobile has with mobile network operators means SpaceMobile will profit from each IoT device connected to its network.

AST is a U.S.-based company with a manufacturing and operations facility in Midland, Texas, and R&D offices in Maryland, Spain, Space Park Leicester in United Kingdom and Israel [29,23,30]. AST has a growing team of 566 [31].

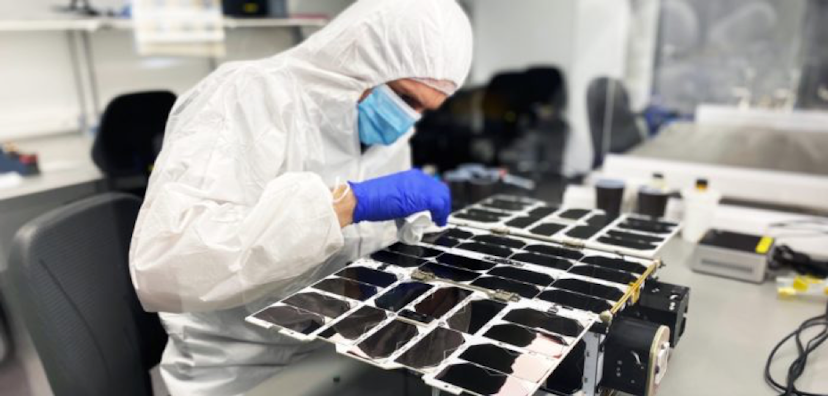

Photo source: https://ast-science.com/51% AST-owned nanosatellite manufacturer NanoAvionics [32] has sites in Lithuania, UK and USA. NanoAvionics is currently pending sale [33] for $28M in net proceeds to AST.

On April 6, 2021, SpaceMobile merged with a SPAC named New Providence Acquisition Corp. (NASDAQ:NPA). After closing of the transaction, AST SpaceMobile became a publicly traded company. It’s listed on the NASDAQ exchange under the symbol “ASTS”. All AST SpaceMobile shareholders retained 100% of their equity in the combined company. [34]

To quote Adriana Cisneros [35], an investor in AST SpaceMobile:

“It’s the coolest thing I’ve been ever involved with, and if we pull this off, it’s not only going to be the most important thing that we do as a business group in the hundred years that we have been around, I also think it’s going to be thought of as one the greatest innovations to happen in our generation.” [25].

You can listen to Adriana’s thoughts about her SpaceMobile investment in an investing podcast KindredCast starting at 6:30. [36]

In mid 90s, Adriana's father Gustavo Cisneros of Grupo Cisneros launched the first ever direct broadcast satellite and brought satellite television to Latin America. [37]

AST SpaceMobile CEO is Abel Avellan. Abel has a long history in the communications industry. After graduating college in his native Venezuela, he moved to Sweden and joined telecom giant Ericsson as an engineer. A few years later, in 1999, he founded satellite communications company Emerging Markets Communications, which provides high-bandwidth connections over satellite for video and other applications. He sold EMC in 2016 to telecom company Global Eagle for $550 million. Fresh off that sale, he founded AST. [38,25,39,40]

SpaceMobile will work for consumers as follows: When subscribers exit mobile coverage, they will receive a text message from their wireless provider that offers access to SpaceMobile connectivity. With a simple “yes” response via text, the user will receive a day pass. This pass will be an add-on charge to the subscriber’s monthly bill. Subscribers will also have the option to add ongoing SpaceMobile connectivity as a monthly subscription, ensuring seamless, uninterrupted service. [41] A stand-alone plan will be available to use SpaceMobile as the primary network in areas without cellular coverage [29].

As of December 1, 2020, AST has entered into agreements and understandings with mobile network operators which collectively cover over 1.8 billion mobile subscribers of which at least 790 million mobile subscribers are covered by binding and mutually exclusive agreements that provide for revenue-sharing with AST. AST estimates that the global market opportunity for its services is $1.1 trillion, according to GSMA market data. [29]

SpaceMobile will be offered to mobile network operator’s subscribers under 50/50 revenue share agreements [42].

Both Rakuten and Vodafone - investors in AST - publicly announced that SpaceMobile is coming and will dramatically improve geographic mobile coverage using satellites [43,44].

Recently, American Tower’s CTO Ed Knapp highlighted some of their reasons for partnership with SpaceMobile in a YouTube video:

Vodafone, American Tower and Rakuten all publicly suggesting the technology is a done deal is a promising sign.

Timeline

Following the BW3 launch (exp. mid-Sep 2022), we can expect the phased array (satellite) unfolding in orbit in about 2 months [45]. This represents some technical risk, so a successful unfolding might be a positive stock catalyst. In the 4 months following successful unfolding, AST will be performing connectivity tests with regular phones in cooperation with mobile network operators on all 6 inhabited continents. In the meantime, AST will be ramping up manufacturing capacities.

ext, they will launch 5 first-generation "BlueBird" satellites (same size and technology as BW3 [46]) which should fit on a single Falcon 9 rocket in late 2023. With these satellites online, the company expects to start commercial service and to generate first revenue in early 2024.

Following that, AST launch additional 15 second-generation (2x bigger) satellites. These 20 total satellites will cover the equatorial region (49 countries, 1.6 billion people), which has a large portion of unconnected population - particularly in India and Africa.

The equatorial constellation will cost a total of about $300-340M. They chose to launch the equatorial network first because this

network requires the fewest satellites for full coverage, and their partner Vodafone already has 500 million subscribers in the region [41], who can immediately use SpaceMobile’s service.

AST will continue launching more satellites over the following years. A total of 110 satellites will provide full global mobile coverage. A total of 168 satellites will add 5G support afterwards. [27,47].

While the estimates above are up-to-date as of now, the actual timing of satellite deployments is a moving target and already delayed by at least a year as compared to original AST management estimates presented in 2020.

Manufacturing and supply chain resilience

"Abel Avellan said during the company’s earnings call that AST SpaceMobile is on track to complete a second manufacturing facility in Texas by the end of 2022, which would enable the company to ramp up to producing six satellites a month the following year." [48]

"He said AST SpaceMobile is confident its expansion plans will not be caught up in supply chain issues that have delayed other satellite projects." [48]

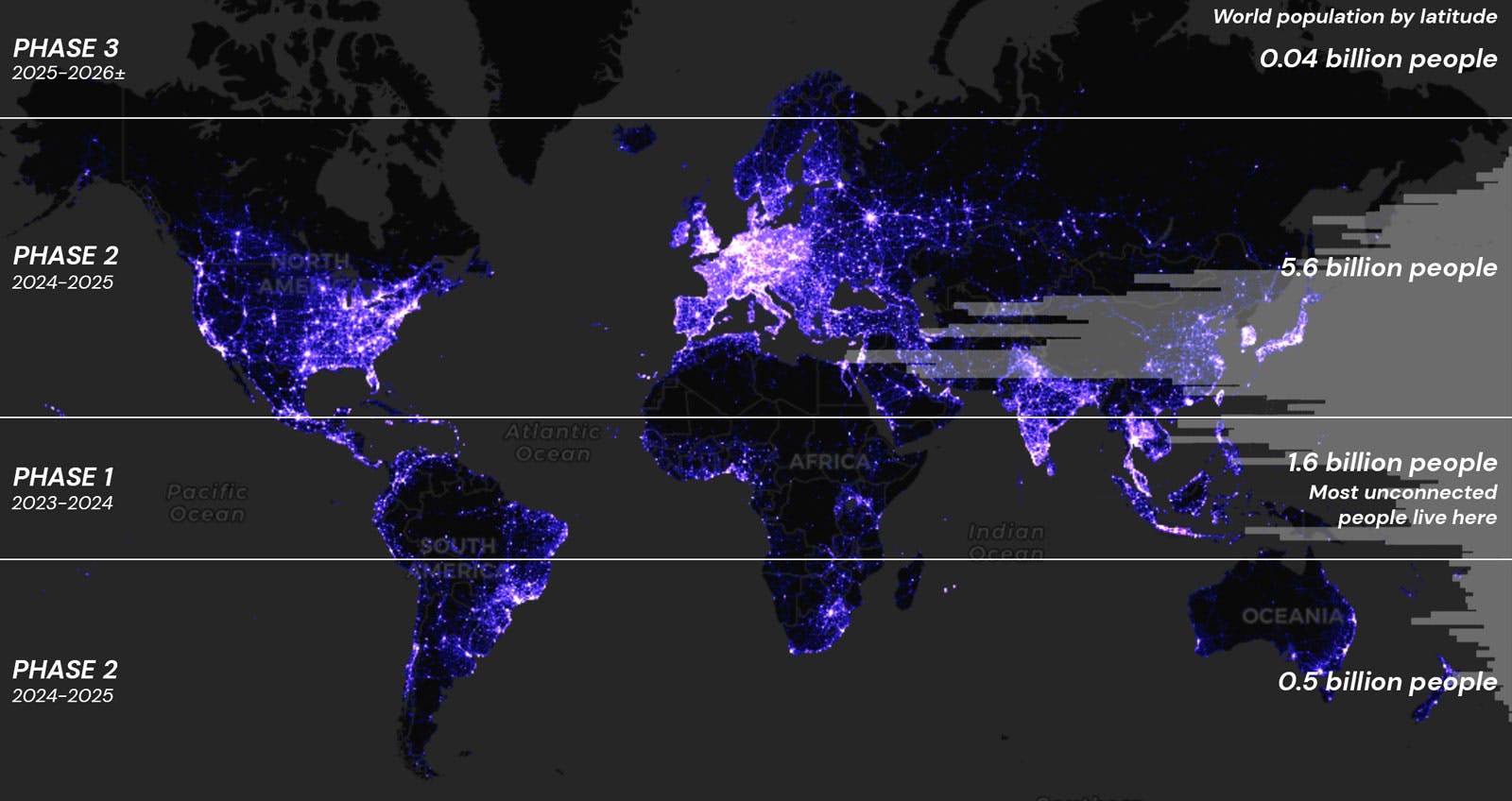

The satellites will feature 900 square-meter large phased array antennas, with a hard-body radius of 30 meters, weighting well over 1.5 tons [49], and a peak gain of 47 dBi [50,51,52]. The way they can do this is by self-assembling the final structures in space [25]. Each SpaceMobile satellite will be composed of identical modules linked together, reducing manufacturing costs [53].

The following GIF illustrates how the satellites are designed to orbit Earth:

Source: AST SpaceMobile Twitter - [54]The AST satellites are absolutely huge in comparison to other comparable satellites [51]. For example, Starlink satellites have a cross-section of 32 meters squared [55]. In fact, AST satellites are so large that the National Radio Astronomy Observatory is concerned the light-reflecting surface area of the satellites will have a significant effect on the appearance of the night sky [56].

As KookReport explains [57]:

ASTS’ satellites are ~10x bigger than the norm because they are essentially cell-phone towers in space. With a 900-square meter array, it's a large “loud” system that can connect with a regular mobile phone. Traditional satellite phones “listen hard” whereas ASTS simply produces a loud signal to connect to regular mobile phones.

Note: The final satellite size is kept secret by the company. According to an analysis by ASTS investor community member CatSE, the final production BlueBird satellite size could be as small as 336 square meters thanks to ongoing engineering improvements. [58]

Contemporary mobile phones have enough power to reach a terrestrial cell tower up to 72 km away [59]. Thus, it makes sense AST needs huge satellites with powerful antennas in order to receive the faint mobile phone signal from a distance of 700 km [60]. No clear line of sight of the satellite is needed [61], and the service should work even indoors, on planes and at sea [26]. The communication delay (latency) will be about 20ms [62,63]. The SpaceMobile service will meet and exceed the download and upload speed of 35 Mbps / 3 Mbps [63].

A question remains over what network performance will look like once the user base widens meaningfully, as network congestion has historically been the largest issue with satellite internet [64]. However, AST constellation is designed in such a way that they can launch additional satellites to increase the capacity.

Expected satellite lifetime is 7-10 years [65,66].

AST has 2400+ patent claims and a team of over 200 space scientists and engineers inc. 24 PhDs [5,67]. Additionally, Vodafone has been working with AST developing and testing the technology since September 2019 [42,68].

Existing investors doubled down on AST in the NPA SPAC accompanying PIPE transaction. According to Abel Avellan (the CEO), Vodafone and American Tower were doing due diligence of AST and their technology for years [69,70].

Lynk, a SpaceMobile competitor, was able to send a text message from LEO (low-Earth orbit) test nano-satellite to a common Android phone on the ground [71,72]. Since they managed to do this using a nano satellite, it gives us a signal to the validity of SpaceMobile technology and their several orders of magnitude bigger satellites.

Test satellites

AST launched a BlueWalker-1 satellite in April 2019 to test their technology, and proved it could establish a link directly to cellphones [73]. They launched a tiny satellite to space to act as a handset (mobile phone), while keeping the large satellite prototype on the ground (codenamed BlueWalker-2), which allowed fine-tuning the prototype [27,26]. BlueWalker-1 was a 6U cubesat built by NanoAvionics [73]. The test also

showed that AST’s cellular architecture is capable of managing communications delays from LEO orbit and the effects of doppler in a satellite to ground cellular environment using the 4G-LTE protocol [27].

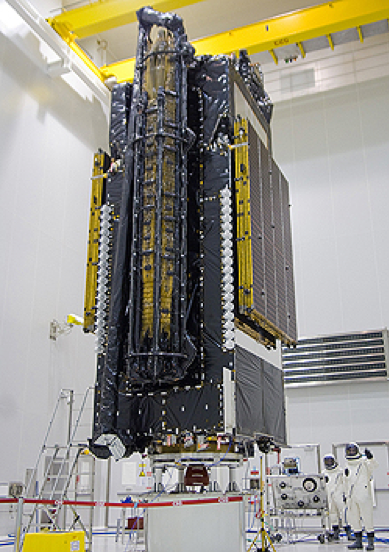

Additional 1.5 ton, 64~ square meter test satellite BlueWalker-3 (BW3) is scheduled to launch mid-September, 2022 [58]. In order to do so, AST has signed a multi-launch agreement with SpaceX, covering not only the launch of BW3, but also providing a framework for future launches, such as the BlueBird production satellite. [74]

BlueWalker-3 test satellite. Source: [75]The BW3 test satellite is expected to enable live ground, sea, and airborne testing with unmodified LTE and 5G devices such as smartphones, tablets and internet of things (“IoT”) equipment. The satellite is also expected to enable live testing for voice, video and data. [29]

BlueWalker-1 is still orbiting the Earth and can be tracked online in real-time, e.g. on the n2yo.com website [76]. BlueWalker-3 will be also trackable after it’s launched.

Because BlueWalker-3 has the full technology stack implemented [77], we expect its successful launch to be a key “catalyst” and technological de-risking & validation event accelerating the growth of SpaceMobile investor base (and the stock price in tandem).

That said, we expect high stock volatility leading up to the launch and after it. If there's too rapid stock price increase leading up to the launch, the stock might possibly experience a typical "sell the news" event, temporarily falling on successful launch.

The following video by AST explains how the BW3 mission will work:

BlueWalker-3 Ground Test Successful. Source: TwitterOn June 11, 2022, AST CEO Abel Avellan announced "BlueWalker 3 end-to-end (ground) test conducted successfully this week. We also got the satellite fueled for our planned summer launch." on Twitter [78].

RKF Engineering’s David Marshack’s Technical Due Diligence

On virtual analyst day (Jan 22, 2021), David Marshack (COO of RKF Engineering [79]) shared his

thoughts on AST risks. Here are the key points:

- RKF Engineering got involved a few years ago already on behalf of AST investors, working closely with the AST team building the satellites

- BlueWalker-1 and BlueWalker-2 prototypes proved that the phone-satellite connection works. This greatly lowered the risk that the connection won't work.

- BlueWalker-3 will be smaller than a full satellite but it will use the exactly same components. It will de-risk the components and help with the final debugging.

- He doesn't see anything that would prevent BlueWalker-3 going up this year

- The satellite is nothing new, but a constellation like this was unaffordable before due to launch costs and component costs

- Most of the risks he sees are timing risks. Final tweaks of the technology, launch vehicle delay (e.g. weather), key components delays could delay the project by several months. He says satellite program delays are common.

- AST is assembling the satellites themselves in Midland, which removes some of the major delay risks

- There is redundancy built into the satellites. The satellites can handle damage as they are built form many identical components (mass produced "microns") that can re-route power and other capabilities around the satellite if it gets damaged.

- The magical thing is the patented (software) backend that makes it possible to connect to phones directly. The patents are insured with Lloyd's of London.

- Key takeaway: He doesn't see any major technical risk. In fact, what AST is doing was already possible before, but it was unaffordable and the magical backend processing wasn't invented yet.

Conclusion

All in all, the technology looks promising and is already partially validated. Vodafone and American Tower with their talented engineers have vetted the company and even increased their investment in the PIPE.

AST investors are eagerly awaiting successful BW3 test satellite launch in mid-September and the results from the following 6 month testing period. Once the technology is fully validated, the remaining key risks will remain in execution (mass manufacturing and at-scale deployment and operation of satellites) and regulatory approvals.

Funding history

Leading up to the "IPO" via NPA SPAC merger, the company received $588M~ total funding. Here’s the breakdown:

In January 2017, the company was seeded with $6M by the company CEO, Abel Avellan [27].

In June 2018, Series A funding resulted in additional $10M funding by Cisneros [27,80].

In October 2019, Series B funding brought in $110M from Vodafone, Rakuten, American Tower and Samsung Next [27].

NPA SPAC trust contributed $232M in April 2021, and the NPA PIPE contributed additional $230M. It was led by AST SpaceMobile strategic partners, including Vodafone, Rakuten, American Tower, UBS O’Connor (hedge fund) and other financial institutions [69,81].

Ownership and control

The table that follows sets forth estimated beneficial ownership of securities (< 5%) after the business combination [29]:

| Abel Avellan (majority voting power) | 47.5% |

| Rakuten | 18.1% |

| NPA SPAC shareholders and sponsors | 16.0% |

| Adriana Cisneros | 6.3% |

| Vodafone | 5.8% |

| American Tower | < 5% |

| Samsung NEXT | < 5% |

| Others | The remainder |

As the company is now publicly traded, the current ownership percentages might differ. However, it currently seems that Mr. Avellan nor any of the early investors are divesting at these early stages of the company. [82]

Abel Avellan, CEO & founder has majority (88.3% [83]) voting power. This is a great sign, as founder-led companies tend to outperform and out-innovate companies with hired guns at the helm [84] (think Tesla, Netflix, Amazon).

Abel Avellan, CEO & founder has majority (88.3% [83]) voting power. This is a great sign, as founder-led companies tend to outperform and out-innovate companies with hired guns at the helm [84] (think Tesla, Netflix, Amazon).

The fact that Mr. Avellan was able to retain majority voting control through several funding rounds with top-tier investors is a positive signal.

Phase 1

After fees, the reverse merger injected around $423M cash to the company. All of the cash will be consumed for Phase 1. The cash will be used for the manufacture and deployment of the first 20 equatorial BlueBird satellites (Phase 1), along with $128M the company raised to date.

Phase 1 also includes buildup of manufacturing facility, BlueWalker-3 test satellite, ground infrastructure and others. Direct expenses projected for the manufacture and launch of the 20 satellites were projected to be $259M originally [27], but got revised to $300-$340M (16-31% higher) during the 2022 Q2 call. [85]

Phase 1 aims for full equatorial coverage with 20 satellites. It will cover 1.6B people across 49 equatorial countries, 700M of which are currently unconnected.

AST was fully funded for Phase 1 based on original cost projections, but due to increased costs on various fronts, it will need to raise a modest amount of additional capital in order to enter commercial service with the first 20 satellites in 2024. The first 5 out of these 20 satellites could enter intermittent commercial service as early as very late 2023. [85]

Phase 1 budget breakdown

For Phase 1, the budget per satellite was originally about $13M, now about $16M. [85]

This seems to be realistic in comparison with other satellite projects. Deutsche Bank provides a comparison to Telesat [83]:

“Telesat's Lightspeed constellation is estimated to cost $5-6B for its 298 satellites ($18.5M per satellite). The Lightspeed satellites are more advanced than AST's, thus they should cost more than AST's, even though they are smaller.”

Let’s break the satellite cost further (manufacture + launch).

Each SpaceMobile satellite should weigh about 1.5 tons.

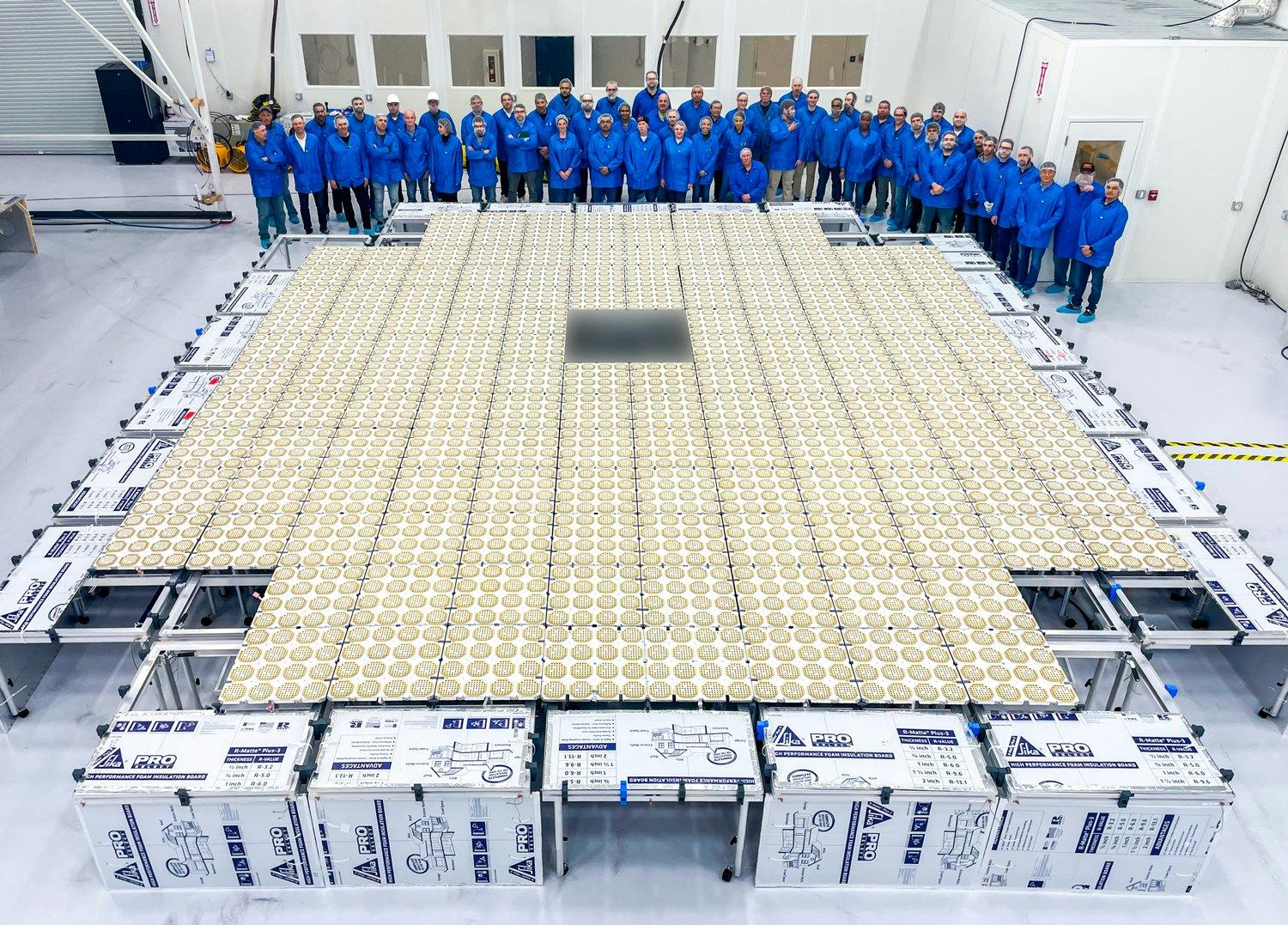

SpaceX’s Falcon rockets can achieve prices as low as $1.4k - $2.7k / kg for low-earth orbit launch [86]. While busy with frequent Starlink deployment flights, SpaceX regularly flies primary missions for 3rd party customers as well [87].

On March 9, 2022, SpaceMobile secured SpaceX as their launch partner [88], which is tremendously positive news for shareholders, as SpaceX is the cheapest option by far. This news nearly doubled the stock price (and rightly so, as it dramatically increased the available manufacturing budget per satellite). However, in the following 4-5 months, the stock price fully returned to its previous levels due to macroeconomic factors.

Based on the launch costs listed at Wikipedia [86], the deployment of a 1.5 ton satellite will cost $2.1M to $4M each, thus $42M to $80M for 20 satellites.

This will leave AST SpaceMobile with a $220M to $298M (as the total budget is $300-$340M) budget for the manufacture of all Phase 1 satellites, or $11M to $14.9M per satellite. That’s $7.3k to $10k per kg of satellite. Is this price achievable?

In comparison, NanoAvionics (until recently a 51% owned subsidiary of AST) 16U satellite bus has a max weight of around 15 kg [89], and costs hundreds of thousands of EURs [90].

AST SpaceMobile plans to build their huge satellites from lots of small modules, which makes comparing AST satellites with NanoAvionics nanosats not completely unreasonable. Assuming the 16U NanoAvionics bus costs $250k, that’s $16.5k per kg.

So AST has to cut the costs of NanoAvionics satellites by about 50%. Subtracting NanoAvionics profit margins from that differential, accounting for fixed costs (which represent a much higher percentage of the total cost for small satellites) and also accounting for AST's mass production $30M 185,000 square foot satellite assembly plant in Texas, and the fact AST wants to build the satellites from relatively cheap identical modules, it seems economically feasible.

In conclusion, the budget for the first 20 satellites (Phase 1) seems realistic.

Phases 2, 3 and 4

Phase 2 will launch 45 satellites to cover North America, Europe and Asia. It was originally scheduled for 2023 - 2024, but we expect a postponement till 2024 - 2025.

Phase 3 will launch 45 more satellites for full global coverage. It was also originally scheduled for 2023 - 2024. Given the launch delays, we suspect it will get postponed to 2025.

Phase 4 will launch 58 satellites for 5G and MIMO - using multiple antennas to communicate with a single device for faster speeds; originally scheduled for the end of 2024.

Phases 2-4 will require $1.4B of additional capital expenditures. Per the investor presentation, the company plans to get them funded through a potential mix of debt / equity.

AST might also be able to get non-dilutive financing from their commercial partners [77] and subsidies from the US 5G Fund (see the next section). AST also expects to generate $28M net proceeds from its sale of NanoAvionics subsidiary [33].

Out of the additional $1.4B required, SpaceMobile already has $202M~ secured in the (possibly near) future from their warrants. They issued 17,600,000 warrants and can get $11.50 per warrant once they call them for redemption (1 warrant + $11.50 = 1 share of ASTS). The requirement is that the stock price “equals or exceeds $18.00 per share for any 20 trading days within a 30-trading day period”. Once the requirement is met, the company can call the warrants for redemption and warrant holders will have 30 days to exercise their warrants [29].

The management originally expected to generate $181M in revenue in 2023 already, and over $1B in revenue in 2024. [27]. We expected these revenue streams will get delayed by 12-24 months, though.

It’s fair to assume that SpaceMobile’s goal is to roll out Phases 2, 3 and 4 as soon as possible, even at the cost of potential equity dilution (= issuing new shares to cover the cost). That said, we expect the company to do its best to keep the dilution as low as possible and to be opportunistic with getting non-dilutive financing (such as loans and subsidies), given the tremendous growth potential for shareholders. Striking a balance here is one of the key strategic challenges facing the management.

The company is already pursuing multiple non-dilutive financing options. If it manages to secure one or more of such funding sources, the market should interpret that favorably. Such an event would definitely be a potential stock price catalyst.

It’s of interest that Deutsche Bank, a potential financing partner for ASTS, expected no dilution for ASTS in their initial research analyst’s model [83].

On May 6, AST announced "the right, without obligation, to sell and issue up to $75 million of its Class A Common Stock over a period of 24 months to B. Riley at AST SpaceMobile’s sole discretion" [91]. If AST takes advantage of this option, we assume it will around a key milestones (e.g. after a successful BW3 launch or test results).

If AST raises funding through equity and thus dilute existing shareholders, the market might interpret that negatively in the short-term. If that’s what it takes to roll out the global coverage sooner, we are generally supportive of such a move. Insisting that the company intentionally slows the global coverage rollout just because it can’t get non-dilutive funding would be the wrong strategic move.

Here’s why -

The potential revenue from global coverage is tremendous, and will quickly pay for any financing costs incurred to generate it. The company originally projected over $1B EBITDA (gross profit) for 2024 already, and over $2.6B for 2025. [27]

For completeness sake, as a thought experiment, let’s also consider the scenario where the company doesn’t get any further financing at all, and instead fully boot-straps by re-investing the revenue it will generate from Phase 1. While theoretically possible, this would result in at least a several year delay of Phases 2 to 4 and would also possibly hinder the commercial agreements AST has in place and provide a window of opportunity for competitors to sweep in. This scenario is both extremely improbable and undesirable.

In any case, once the company starts generating revenue, we expect it will get a large portion (possibly most) of its financing through debt and other non-dilutive options. Share buy backs will be also on the table soon after the company has enough cash to finance all its satellites, effectively reversing any dilution incurred initially.

for each 100 ASTS shares you buy, you will own and operate 0.24 kg (0.54 lbs) of a satellite in space, 38 x 38 cm (= 14.96 x 14.96 inches) large. That's larger than an 12.9" iPad Pro, which costs $1,099.

If everything goes great, by 2030, your tiny piece of satellite could generate $2,694 in revenue per year. At 96%+ projected profit margins, most of it will be pure profit, too! This could be worth $51,400~ of market cap (or $514 per share).

Of course, you will also own a slice of all the patents, software, ground facilities, pay your slice of AST's employees' salaries, etc.

(Assumes 336 satellites deployed, each 900 sqm large and 1500 kg heavy, 210,800,000 ASTS shares outstanding, and other assumptions from our scenario in our valuation model [92]. It is possible that the final satellite size will be smaller due to engineering improvements [93]).

Satellite replacement costs

Given the expected satellite lifetime of 7 - 10 years, AST will have to start replacing satellites by as early as 2029. The estimated total cost to build and launch all of the satellites is $1.7B~. This estimate does not consider any cost savings from volume ramp up, falling launch prices, etc. The company originally expected 2029 EBITDA of $14B, so replacing the satellites should not be an issue.

5G Fund

In 2020, AST SpaceMobile participated in the public comment period regarding the FCC’s 5G Fund for Rural America. Afterwards, FCC formally moved to allow mobile-satellite providers that meet specified performance standards and other requirements to apply to participate with its partners in the 5G Fund auction as a 5G broadband provider. The 5G Fund will distribute up to $9 billion for 5G wireless broadband connectivity in rural America to close the digital divide [94] - which also happens to be the major goal of AST SpaceMobile.

The U.S. Senate recently encouraged the FCC to address regulatory hurdles and promote innovative space-based cellular broadband communications to existing mobile devices [95].

AST is interested in the subsidies offered by 5G Fund and expects to be an active participant in the 5G Fund auctions [96,97]. Given the goals of the fund (getting a country-wide 5G coverage), SpaceMobile is well positioned and possibly the single “best shot” the fund has.

Abel Avellan is confident that SpaceMobile will get a portion of the fund. [77]

Any awards from the fund are a potential stock price catalyst, because they are essentially “free” cash to help the company grow, without any dilution of the shareholders.

Note: Non-dilutive government / subsidy financing is very common in the space industry, due to high upfront costs and national interests at play.

On August 10, 2022, the U.S. Federal Communications Commission rejected SpaceX's Starlink and LTD Broadband's applications for more than $2 billion in internet service subsidies [98]. It is notable that ASTS stock price reacted favourably to this news on large volume, suggesting that the market participants now expect ASTS to possibly receive more from the fund, or to have a higher chance of receiving a subsidy in the first place.

Conclusion

To conclude, based on the company estimates and plans, AST is fully funded for commercial launch with Phase 1 (equatorial coverage), and has several options to secure funding for Phases 2 to 4 (global coverage) to scale rapidly.

Regulators

U.S. regulators

On April 13, 2020, AST&Science filed an application requesting access to the U.S. market for its constellation of low-Earth orbit satellites [99]. There is a wealth of information present within the application and subsequent comments from multiple parties.

First and foremost, it is against the Federal Communications Commission (FCC) regulation to transmit signal from space over terrestrial frequencies. In other words, given the contemporary regulation, no one can broadcast 3G, 4G or 5G signal from space.

AST SpaceMobile does not intend to apply for and own a terrestrial frequency license, but they still intend to transmit on these frequencies based on a license leased from their partners. Thus, AST requested waivers in order to be in compliance, and awaits FCC decision. Either a waiver or FCC rule-making is required for AST to access the U.S. market. An experimental license was already granted for the BlueWalker-3 test satellite, paving the way for future grants [100].

A number of third-parties submitted comments to the AST application, both to support and to deny the application [101,102].

SUPPORTERS INCLUDE:

- Samsung NEXT

- Investor in AST

- Support is obvious and biased

- Rakuten Mobile Americas

- Investor in AST

- Support is obvious and biased

- U.S. Senator Ted Cruz

- Praises connectivity for hard-to-reach areas

- AST can serve as a backup communication during national emergencies and natural disasters

- U.S. Senator Benjamin Cardin

- Connectivity for hard-to-reach areas

- 5G for U.S. citizens

- U.S. Senator Chris Van Hollen

- 5G for rural and hard-to-reach areas

- U.S. Representative Michael Conaway

- 5G for hard-to-reach areas, and in emergency situations

- Midland Development Corporation

- A development company run by the city of Midland, Texas

- AST headquarters and satellite manufacturing plant will be in Midland

- Commercial Spaceflight Federation

- U.S. to lead the world with 5G thanks to AST

- U.S. to stay ahead of China

- 5G for rural areas

OPPOSITION INCLUDE:

- CTIA

- A trade association representing wireless industry, used to represent mostly cellular carriers, who likely still play a lead role in the association

- Use of terrestrial mobile spectrum for satellites is not permitted

- Fear of signal interference

- Verizon

- A cellular carrier

- Vocally negative towards AST

- Signal interference

- Mobile services from space is against FCC rules, terrestrial spectrum cannot be used by satellites

- LTE protocol is designed with latency requirements consistent with small area coverage within each cell, and not designed to operate with a space-based network latency

- AST interference is unavoidable, because any cellular network needs to actively advertise (broadcast) its service availability to devices

- Other interference and frequency use issues

- AST not entitled to waivers

- T-Mobile

- A cellular carrier

- Vocally negative towards AST

- SpaceMobile is “inconsistent” with public interest, convenience, and necessity

- Numerous procedural deficiencies should lead to dismissal

- Terrestrial mobile spectrum cannot be used by satellites

- Rule-making by the full Commission necessary for request approval

- Complains that AST is competing with T-Mobile in bringing 5G to rural areas

- Signal interference issues

- EchoStar / Hughes

- A satellite communication and internet provider

- The most active participant in the hearings, sent a total of 4 letters to reject AST

- Very negative towards AST

- Various spectrum usage and licensing issues

- AST must not offer mobile services through their satellites

- Debris mitigation issues

- However - as of August 2, 2022, it seems that EchoStar is no longer asking FCC to deny AST [103]

- TechFreedom

- A technology think-tank

- Concerned about space debris

- NASA

- Concerned about space debris and satellite collisions [51]

- National Radio Astronomy Observatory

- Radio frequency issues

- Signal interference

- Satellite body light reflection issues at night

The loudest opposition to the AST application comes from companies that are competitively threatened by AST technology.

NASA raised some concerns about possible satellite collisions and debris management [51]. As a result, AST reached out to NASA and shared confidential technical information regarding the SpaceMobile system with the agency [104]. Since then, NASA started collaborating with AST to facilitate safe operations in space [105,95]. While NASA still keeps its technical concerns in order to protect its assets in orbit - as it should - the issues raised by NASA to FCC need not preclude the issuance of the requested license [105].

EchoStar - a satellite communications company [106] - is directly threatened by AST SpaceMobile. They offer rural broadband connectivity via Satellite Services [107]. Their HughesNet is a satellite internet with millions of subscribers across North and South America [108]. EchoStar Mobile is a mobile satellite service in Europe [109]. HughesNet is likely going to be rendered obsolete by Starlink. EchoStar Mobile will be rendered completely obsolete by AST technology. EchoStar’s current enterprise value is $2.43B compared to AST SpaceMobile’s $1.4B.

T-Mobile - a global wireless carrier - amusingly claims that AST application should be rejected because T-Mobile is in the process of deploying their own 5G solution to cover rural areas, and AST solution would interfere with T-Mobile’s plans to cover the market [110, page 12] T-Mobile, in their letters, is extremely dismissive to AST SpaceMobile’s application, and an astute reader can infer their intention of blocking a competing technology company from entering the market.

Even though competitors claim potential issues with signal interference, AST is determined to only operate within the licensed frequency bands with their partnered MNOs. Aside from the regulatory existence of so called "guard bands", that exist to protect distinct frequency ranges, AST uses different interference management systems to ensure coexistance with other systems and channels [111]. A detailed technical explanation on this was provided to the FCC [66].

As a side-note, AST SpaceMobile technology would help FCC reach one of its main goals - bridging the Digital Divide - by bringing high-speed broadband internet to all Americans [112]. This gives AST a chance to receive funds from the $9B 5G Fund as discussed above.

AST also will need to secure FCC authority in the future for the ground segment of the SpaceMobile Service, namely two or three fixed earth stations located in the United States. [29]

Because the SpaceMobile Service will be using satellites transmitting on spectrum traditionally licensed to mobile network operators, AST also will need the approval of the Wireless Telecommunications Bureau, which handles terrestrial wireless licensing. AST intends to seek this approval in connection with a spectrum lease agreement with a terrestrial wireless carrier which AST has a cooperative arrangement. Certain wireless carriers have indicated that they intend to oppose this approval on procedural and substantive grounds. [29]

We believe that AST SpaceMobile should be allowed to operate outside of U.S. markets even before receiving FCC and other required U.S. approvals, as the Phase 1 targets equatorial markets, not the U.S. That said, given the support AST has received up to date, we believe its lobbying power should be sufficient to get the necessary U.S. approvals.

International regulators

As we have seen with the U.S. FCC application, local competitors are very much interested in AST not being granted access to the market. Hence, it is not a stretch to expect similar obstructions happening when AST inevitably applies for market access in other countries.

AST SpaceMobile Phase 1 focuses on 49 equatorial countries, of which vast majority are emerging markets – unfortunately some with the possible corruption and clientelism that comes with it. There is the risk of local established players using their connections and bribery to deny AST market access.

One potential political bear argument is that communications are a critical national infrastructure, and to some regimes and military juntas also a potential existential threat. During civil unrests or coups, less democratic governments typically resort to communication blackouts - such as the 2021 Myanmar coup [113]. India, a country of prime interest to AST [27], restricted internet use more than any other nation in 2020 [114]. Turning off terrestrial cells and cables is straightforward for a local government. The government or the military in some countries might be worried that they cannot easily turn off AST network when they need to. However, this doesn't make sense from a technical standpoint, as AST satellites need to talk to regional ground stations to relay the signal.

All that said, Vodafone, AST key partner, already successfully operates in many of these markets, and can thus lobby on behalf of AST to get the necessary approvals. We believe they will be able to get the job done, as AST already received licenses in several equatorial countries [41].

The World Bank estimates that every 10 percent increase in broadband penetration in developing countries raises GDP by 1.4 percent [115]. That’s huge, and it’s the main reason why governments in emerging markets would want to approve AST.

Vodafone will integrate SpaceMobile technology into the services provided by its Vodacom, Safaricom and Vodafone brands. Subject to regulatory approval in each market, these will include Congo; Ghana; Mozambique; Kenya; and Tanzania. AST SpaceMobile will also apply for regulatory approval to launch the service in India. [34]

The already approved permits include Nigeria [116] for the equatorial constellation. Nigeria is the most populous African country with a population of 207M and is the 27th largest economy in the world.

Vodafone received a license in Ethiopia [117,118]. Ethiopia is the second largest country in Africa with a population of 115M.

AST also already received a license from Papua New Guinea to operate its constellation. [29]

It is reassuring to see that AST keeps onboarding new commercial partners which can help with local licensing efforts. For instance, on July 6, 2021, AST signed a new Philippine partner (Smart Communications), to extend SpaceMobile cellular broadband connectivity to 70M~ subscribers in the Philippines mainland, islands and surrounding waters after the service is launched. [119]

What if AST is not allowed to operate in some countries?

It is possible that AST will not be allowed to operate in some countries. However, this shouldn’t be a problem for AST commercially given its arguably conservative subscriber growth projection.

The equatorial region AST targets has a population of 1.6B [27]. AST partnered with Vodafone, and there are almost 271 million unconnected people in Vodafone’s markets. This single partner can offer more unconnected people to AST in the region than AST expects to acquire until 2030 (180M equatorial subscribers).

Undoubtedly AST will need more partners to get to the 2030 numbers, but it looks like just Vodafone alone can carry AST - if need be - in the equatorial region for the critical years 2023 - 2024, as they launch their global satellite constellation. AST already has several other partners as well and keeps closing even more partners. In conclusion, international regulatory risks don’t appear to be a major threat to AST growth.

Constellation graveyard

Let's review certain failed constellation projects from the past and consider whether AST could face a similar fate.

LEO vs GEO satellites

Before we start, it’s important to understand the difference between LEO (low-Earth orbit) and GEO (geostationary orbit) satellites, which differ significantly in their characteristics:

| LEO satellites | GEO satellites | |

|---|---|---|

| Select projects | AST, StarLink, Iridium | GPS, LightSquared, TerreStar |

| Distance to Earth | Close (160 to 2,000 km) | Far (35,000 km) |

| Hardware cost | Low | High |

| Launch cost | Low | High |

| Size | Tiny to large | Medium to large |

| Constellation size | 50 to 1000 or more | 3 or more |

| Space debris risk | High | Low |

| Satellite movement | Orbits Earth every 90 minutes | Stationary against the Earth |

| Signal quality | High (close to Earth) | Low (potential persistent blockages) |

| Latency | 20 - 40ms | 500ms minimum [120] |

| Bandwidth | High throughput | Lower throughput |

| Ground antenna | Follows the closest satellite | Facing a fixed point in the sky |

| Satellite lifespan | 5 to 10 years (atmospheric drag) | 8 to 30 years |

The key difference is latency. Even at the speed of light, GEO satellite can’t perform better than 500ms due to laws of physics, which makes calls very impractical (people talking over each other due to a long delay), and most gaming downright impossible. However, it is good enough for broadcasting (TV, radio, etc.).

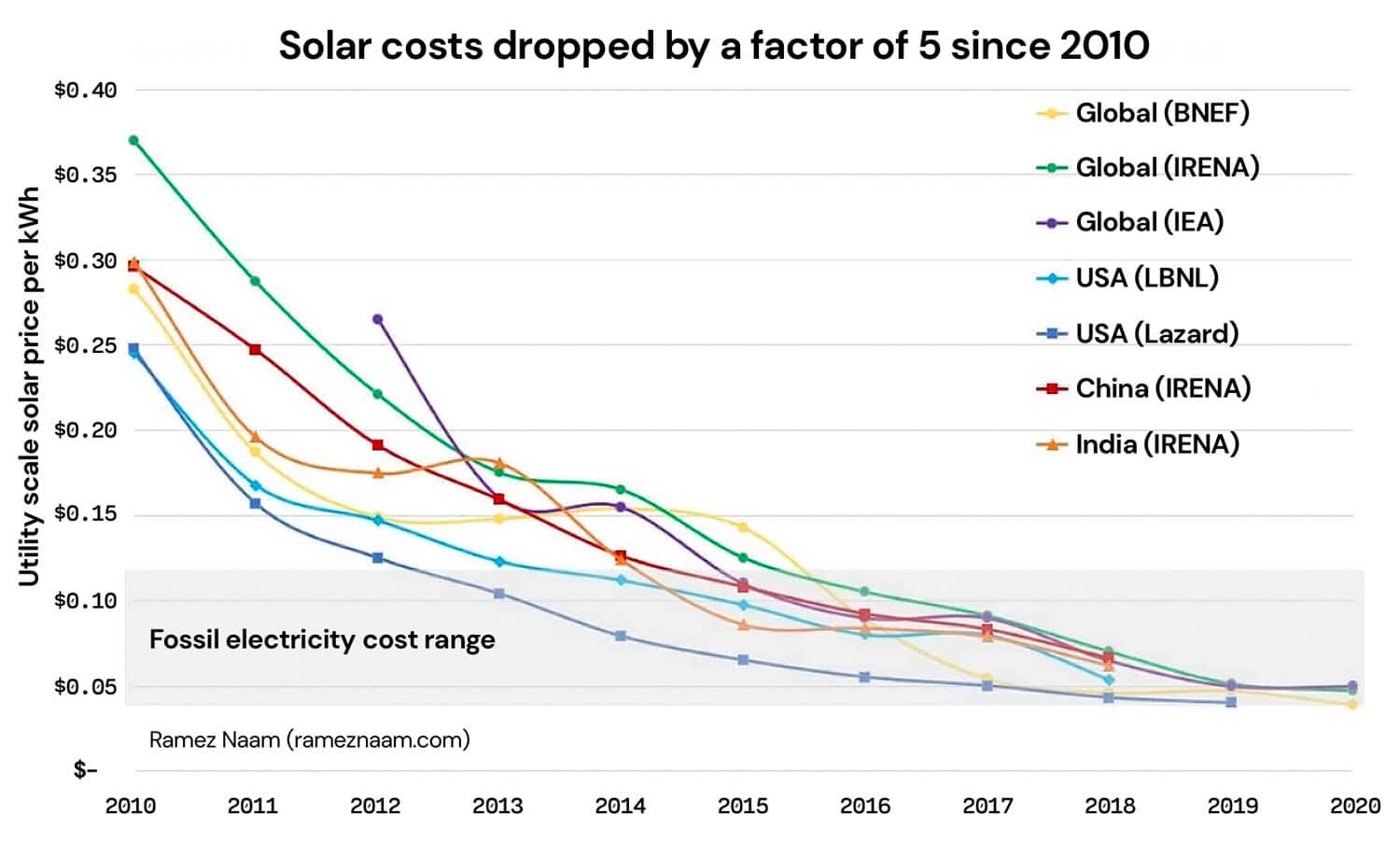

Source [121].Costs now and decade ago

A decade ago, a lot of the technology required for satellites was more expensive [122].

Technology is inherently deeply deflationary (Moore’s law [123] and Wright's law - experience curve effects [124]).

For example, here’s the cost of solar projects across the world. Photovoltaic panels are an important satellite component.

Launch costs have dropped by as much as 90% since 2008 [83].

Another challenge facing satellite companies are frequency use rights, which can cost billions in upfront costs. AST doesn’t have to pay a single penny for the spectrum (frequencies) it will use, because it will lease them essentially for free from its partners under a revenue share model.

Let’s take a short walk through a satellite projects graveyard!

R.I.P. LightSquared

- Time of death: 2012

- Cause of death: GPS interference due poor choice of frequency spectrum

LightSquared was a company with the goal of building a wholesale nationwide LTE network that enterprise customers could then use to provide their own wireless services [126,127].

LightSquared’s SkyTerra 1 geo-stationary satellite. Source [128], credit: Boeing photoLightSquared’s satellite was a geo-stationary (GEO) one, not low-earth orbit (LEO) like AST SpaceMobile.

LightSquared used frequency bands of 1525-1559 MHz and 1626.5-1660.5 MHz, which are close to the 1559-1610 MHz band that GPS operates in. [129] In particular, these frequencies are right next to the L1 primary GPS frequency that is the most important band for navigation purposes, such as in aviation. [130,127]

Frequency band graphics. Numbers are MHz. Source [131]LightSquared’s infrastructure was to contain a ground-based 4G-LTE network as well to provide connectivity more efficiently in population centres. And this network would use the same frequencies as the satellite.

The FCC initially approved LightSquared’s usage of these frequencies even though they had originally been reserved for satellite services alone. However, testing showed that LightSquared’s ground-based transmissions overpowered the faint GPS L1 signals from space [127]. This interference would have profound effects on aviation [132] and dramatically increase the risk of mid-air collisions and controlled flight into terrain.

As a result, there was a vocal opposition to the FCC approval, including from aviation associations, pilots, manufacturers, airlines and helicopter operators. Nine U.S. government agencies also went on record as opposed to the approval.

NTIA, the federal agency that coordinates spectrum uses for the military and other federal government entities, concluded that there is no practical way to mitigate potential interference [133]. As a result, the FCC indefinitely suspended LightSquared’s terrestrial spectrum authorization, pushing it into bankruptcy in May 2012 [134].

LightSquared was doomed by its choice of frequency band. AST satellites, on the other hand, will not operate anywhere close to the exotic (for its purpose) spectrum chosen by LightSquared, therefore, there are no GPS interference concerns.

AST requires frequencies for two purposes: communication between satellites and customers’ phones, on the one hand, and communication between satellites and its own ground stations (gateway links) on the other.

For gateway links, AST’s amended application for frequencies to the FCC asks for so-called V-band frequencies. [135] Boeing, SpaceX, OneWeb, Telesat, O3b Networks and Theia Holdings have all told the FCC they have plans to launch constellations of V-band satellites too [136]. Furthermore, the FCC

has already approved SpaceX’s Starlink to operate using V-band frequencies. [137] In light of this, we see no reason why AST should be denied permission to do the same.

Therefore, it is the communication between SpaceMobile satellites and user cellphones that poses a greater concern, as that is to happen on regular terrestrial mobile network frequencies. SpaceMobile will seek permission for this in a separate process, and this will be the key regulatory hurdle to overcome. However, SpaceMobile is well aware of the issue and if their technological claims hold true, the relevant regulatory approvals should be granted.

In LightSquared’s case, the opposition to their frequency usage permissions came from an entirely different industry that found its operations interfered with, but had no interest in obstructing LightSquared as such. It is a good sign that in SpaceMobile’s case, the situation is very different: the opposition to SpaceMobile’s existing FCC application is composed almost entirely of commercial operators who are competitively challenged by SpaceMobile. It stands to reason that they may be motivated by other factors than genuine technical concerns.

Furthermore, among AST' commercial partners we find established companies with vast technical expertise and accumulated domain experience (incl. Vodafone, AT&T, and Samsung), many of whom are also investors in AST - not least among them American Tower, the largest cellphone tower company in the world. They have performed due diligence on SpaceMobile, and we can assume that they would not have partnered with or invested in the company if they did not believe that AST can successfully operate the satellites without interfering with ground frequencies.

They would know - they are the experts, and in this context, the smart money.

R.I.P. TerreStar

- Time of death: 2010

- Cause of death: bankruptcy

- Contributing factors: required special satellite phone which made distribution difficult

Note: TerreStar is commonly mis-spelled as TerraStar.

TerreStar was supposed to provide a fully integrated satellite and terrestrial mobile network. It used commercial chipset technologies from Qualcomm and Infineon to embed satellite communications capabilities into dedicated smartphones.

Their Genus phone resembled a Blackberry design with a keyboard below the screen and used an internal antenna for terrestrial communications, but required a rather large external antenna for satellite communications. [138]

Needless to say, this does not make for an inherently attractive phone, especially considering that iPhone was introduced already 3 years before Genus!

In addition, it took the phone up to 5 minutes to connect to a satellite, and it did not always succeed as one reviewer points out:

The reviewer in the video concludes:

“I don't see this thing going mainstream anytime soon, and people are certainly not going to be updating their Facebook status on it.”

TerreStar’s satellites themselves were huge (6,900 kg; the world’s largest at the time) and extremely expensive (upwards of $220M per satellite). [141] While no doubt an engineering marvel, they were designed for GEO with all its signal propagation disadvantages (worse latency, lower bandwidth, etc.).

The company accumulated over $1B in debt and was ultimately forced to file for Chapter 11 bankruptcy in 2010 [142].

Former TerreStar veteran engineer David Marshack (now COO of RKF Engineering [79]) performed technological due diligence on AST technology on behalf of investors and while he prudently “hates to say it on a call with so many people”, he “doesn’t see any major technological risks” [143].

It is not difficult to see that AST and TerreStar are worlds apart:

- SpaceMobile will work with regular existing phones without special hardware; TerreStar failed to sell its special Genus satellite phones

- In fact, SpaceMobile already has global distribution secured through its mobile network operator partners such as Vodafone

- AST will operate a LEO constellation with better connectivity and latency than TerreStar’s GEO satellites

- AST has $0 debt and some $420M in cash. It is fully funded for commercial launch. TerreStar was over $1B in debt.

R.I.P. Orbcomm

- Time of death: 2000

- Cause of death: Ran out of funding

- Contributing factors: high customer acquisition costs (CAC)

Orbcomm was a LEO operator that went bankrupt in 2000 [145]. It provided low data rate messaging services for industrial and government clients, who needed special hardware to use the service.

The key differences with AST are:

- It targeted a completely different market (industrial enterprise clients) from AST (smartphone users) with high customer acquisition cost

- It was more than two decades earlier, which means much higher launch and tech costs and significantly less advanced technologies in general. The communication and IoT market was radically smaller back then as well.

- It required special hardware - this is usually the killing blow from a distribution standpoint

As you can see, today’s AST opportunity is not even remotely close to Orbcomm back in its day. Again, AST’s mass distribution is solved and its marginal customer acquisition costs will be roughly $0 thanks to its partners.

R.I.P. Iridium, ICO Global, Globalstar and others

In August 1999, Iridium filed for bankruptcy. The event was dubbed as one of the “The 10 Biggest Tech Failures of the Decade” by the Time magazine [146]

Shortly after, another satellite operator, ICO Global Communications, went into bankruptcy [147].

And in 2003, Globalstar went bankrupt [148] as well.

There was a wave of satellite operator bankruptcies in late 1999 and early 2000’s. As none of these companies were profitable and investors saw one after the other of them fold, investors naturally became less and less willing to invest in the remaining ones, making capital more expensive for them, which in turn made it even more difficult for these companies to move towards profitability. Eventually, more and more of them would be caught in this death spiral.

All of these companies couldn’t reach profitability due to high customer acquisition cost and small (niche) addressable markets. The subscriber growth was lower than the companies needed in order to survive. Customers were not keen to purchase expensive and unreliable hardware.

In most cases, they also had to pay up to a billion dollars or even more just for the right to use specific frequency spectrums.

Today, two decades later, AST gets to learn from their failures and make another attempt with zero user acquisition costs, zero spectrum license cost, 90% cheaper launches, cheaper and better hardware and more advanced software… all while targeting one of the largest markets on Earth – smartphone owners.

The Iridium story is full of drama and unexpected twists. You can learn more about it in the book the book "Eccentric Orbits" [149]. The book also tells the just as fascinating history of satellites in general.

Today, Iridium is a publicly traded company ($IRDM). It still requires special satellite phones. While it seems to be able to keep itself financially afloat, its mobile phone services are in prime danger of getting completely disrupted by AST.

Let’s take a quick inventory of some of the commercial partnerships AST has established up to date.

Vodafone

Vodafone has agreed to a strategic partnership with AST & Science in addition to its investment in the company [150]. The global carrier will contribute technical, operational and regulatory expertise in support of SpaceMobile.

Vodafone has presence in 65 countries, 625 million+ mobile customers and 94 million+ business IoT connections [151].

“At Vodafone we want to ensure everyone benefits from a digital society – that no-one is left behind,” Nick Read, CEO, Vodafone Group, said. “We believe SpaceMobile is uniquely placed to provide universal mobile coverage, further enhancing our leading network across Europe and Africa – especially in rural areas and during a natural or humanitarian disaster – for customers on their existing smartphones.” [152]

AST and Vodafone signed an agreement with mutual exclusivity. Vodafone will make SpaceMobile Service available to all of its customers and promote the service for five years after the launch of commercial service based on SpaceMobile’s Phase 3.

In return, SpaceMobile will provide for exclusivity, making its services available only through Vodafone and no other network operator in the relevant markets, and furthermore share 50% of its revenue with Vodafone. [29]

American Tower

AST will use American Tower facilities for AST’s terrestrial gateways in certain markets. The term of the operational agreement between AST and American Tower is five years after the initial launch of commercial mobile services by AST [29].

In markets in which Vodafone operates, AST will work with Vodafone and American Tower to evaluate and plan deployments [29].

In markets where Vodafone does not operate, AST and American Tower may enter into an agreement for American Tower to manage the operation of the AST-deployed gateway [29].

Rakuten

AST entered into a commercial agreement with Rakuten, for AST’s investments in building network capabilities in Japan compatible with the mobile network of Rakuten and its affiliates [29].

Rakuten will receive unlimited, exclusive rights and usage capacity in Japan in exchange for a $500,000 annual maintenance fee payable to AST [29].

We speculate the reason for the seemingly favorable terms with Rakuten is that Rakuten Mobile is providing AST with Altiostar software [153].

AT&T

AST and AT&T entered into a binding memorandum of understanding to collaborate on the design, implementation, and launch of a space-mobile communications ecosystem [29].

Under the agreement, AST will design, develop, manufacture, launch, manage, and maintain a constellation of 168 satellite to enable continuous satellite-based mobile wireless service across the AT&T coverage area comprised of the continental United States, Hawaii, Puerto Rico, Mexico, and adjacent international waters.

AT&T will provide technical and commercial resources to work with AST to develop service and commercial offerings for the coverage area. AT&T will also give permission to the FCC to authorize AST to test the BW3 satellite under an experimental license on certain mobile bands. [29]

Other partners: Telefonica, Safran, NEC, Samsung, Orange, Nokia, TSMC and more

AST has also entered into a memorandum of understanding with other mobile network operators (MNO), including Telefonica, Indosat Ooredoo, Millicom International Cellular, Telecom Argentina, Telstra, Liberty Latin America Ltd., Smart Communications [119], Orange [154] and others. These memorandums of understanding each generally provide for a non-exclusive arrangement whereby AST and the MNO collaborate on technology development and/or implementation with respect to the SpaceMobile Service. [29]

AST also has numerous equipment supplier partners: Nokia [14,155], TSMC [15], Safran, NEC, Dialog Semiconductors, the until recently 51%-owned subsidiary satellite maker NanoAvionics, and possibly others.

It’s also worth mentioning that AST investors include Samsung’s fund Samsung NEXT, who sent a letter to FCC in support of SpaceMobile [156].

Funds and indices

Technological advancements brought us on the brink of a new space race. Only this time, space is no longer an exclusive domain of national space agencies. The spotlight is on commercial applications coming from an ever-growing number of public and private companies, making “new space” one of the hottest investment sectors in 2020s’.

The space industry inflows are growing rapidly. Quilty Analytics recorded $5.7 billion in investments for the first quarter of 2021, a 356% increase from $1.2 billion in the same period last year [157].

A number of asset managers already jumped in, securing their place early-on.

ARK Invest is one of such firms, focusing on disruptive innovation. Lead by the now-superstar portfolio manager Catherine D. Wood, best known for being one of the earliest bulls on Tesla generating impressive returns for ARK’s investors. In 2020 ARK Invest’s flagship fund ARKK became the largest actively managed ETF after delivering a 170% return.

ARK defines disruptive innovation as "the introduction of a technologically enabled new product

or service that potentially changes the way the world works".

Based on this definition, SpaceMobile is a potentially a good match for ARKK [158].

In March 2021, ARK Invest launched a new Space exploration and innovation ETF (ARKX). The fund focuses on companies that are leading, enabling, or benefitting from technologically enabled products and/or services that occur beyond the surface of the Earth [159].

SpaceMobile fits into that description for ARKX. [160].

Launches of new space focused funds are becoming a common occurrence.

Some of the smaller, more agile funds already include AST SpaceMobile.

Seraphim Space fund planning their IPO on the London Stock Exchange lists AST SpaceMobile as part of their portfolio [161].

As of 8/4/2022 Procure Space ETF (UFO) held 109,165k ASTS shares worth $0.8M~, with a 1.10% weight in the fund. [162].

Increasing fund flows into the space sector and technological innovation / disruption themes can potentially provide a significant price boost to ASTS stock in the future.

As of 8/4/2022, ARK ETFs invested the following amounts into Iridium, an American hand-held satellite phone company [163,164]:

| Fund | Investment |

|---|---|

| ARKK (Innovation) | $0M (down from $320M) |

| ARKQ (Tutonomous Tech & Robotics) | $72.5M |

| ARKX (Space Exploration) | $24.6M |

(Side note: Iridium works only with special expensive satellite phones, unlike SpaceMobile, which will work with regular existing phones. You can learn more about Iridium in the Competitors section.)

ARK ETFs historical total investment of about $500M in 2021 to Iridium would represent a very large percentage of ASTS's current marketcap.

Given the current SpaceMobile market valuation, even a small allocation of ARK funds into AST SpaceMobile should have a substantial effect on the price.

Not to mention that ARK purchases are reported daily by the firm and, given its popularity, influence the markets, as they represent a stamp of approval by ARKs analyst. Numerous followers copy-trade ARK’s moves.

We believe the reason ARK has not invested in AST SpaceMobile so far is because they do not enter positions with binary outcomes, as mentioned by Cathie B. Wood in a CBOE webcast when talking about investments into psychedelic therapeutics clinical-stage companies, which are also binary bets [165].

It is likely ARK Invest will re-consider buying ASTS after further tests are done following launch of the BlueWalker-3 satellite (expected mid-September 2022) or the company generates first revenue (expected 2023 or 2024), at the latest.

AST SpaceMobile can be considered a binary investment - if the constellation works as expected, AST is well positioned to be very successful. But if AST runs into unforeseen technological, regulatory or other issues, they could go bankrupt in the worst-case scenario.

There are also passive funds that might end up including ASTS.

nce ASTS gets added to an index, funds following the index will need to buy shares. These inclusions would further grow the stock price and help reduce volatility. .

Unfortunately, according to a SEC filing [166], AST SpaceMobile is currently not eligible for Russell 2000 [167] inclusion, due to its share composition.

Other larger indices, such as S&P 500, should include AST at various weightings after AST achieves reliable positive earnings following its Phase 1 (equatorial) constellation deployment.

NanoAvionics

AST SpaceMobile owned 51% of NanoAvionics since March 2018, purchased for $3.5 million [27,168]. It was a successful investment for AST, as its currently selling NanoAvionics for $28M in net proceeds to AST [33].

NanoAvionics is a satellite manufacturer with around 80 employees, founded in Lithuania in 2014. They have offices in Lithuania, UK, and USA.

NanoAvionics builds small (6-25 kg), robust, agile, and fast-to-build (~2 months) satellites. The satellites are around 100 times smaller than Airbus or Boeing satellites, but the usual idea is to launch hundreds of them - in order to cover the entire planet in a mega constellation. To be specific, they build satellite vehicles, while the payload (the function, such as telecommunication, observatory, scientific research, etc.) is supplied by the customer. They outsource some of the components, such as rocket boosters and solar cells, and then assemble and integrate the components into the satellite frame.

Image by NanoAvionics [169]The satellites are made of modular units called cubes, which allows scaling the satellites to different sizes while using the same underlying technology. For example, NanoAvionics offers satellites made of 6, 12 or 16 units.

One 16-unit satellite bus (excluding the payload) costs several hundred thousand EUR. Currently advertised prices for payload delivery via SpaceX Falcon is $5k per kg, so launch of the satellite would cost around $100k.

70% of their customers are telecommunication-related, 20% Earth observation customers, and 10% are in-orbit demonstrations (technological or scientific missions). Most of their missions are for low-earth orbit up to 800km, although in the past they were in talks about lunar flyby and deep space missions.

The general contemporary trend with satellites is making them smaller while increasing their functionality - and NanoAvionics specializes in this approach. It takes around 12 months from signing the contract to having the NanoAvionics satellite in space (need to acquire communication frequency licenses, integrate and test the payload, set up ground stations, booking the launch, etc.), all of which they can help their customers to do. [90,170,171]

90 percent of their contracts are for full missions that include satellite bus manufacturing, payload integration, launch, operations (recurring revenue), and other services [172].

They also have a substantial backlog of satellite projects to work on [173]. Their existing paying customers include: NASA, Thales, The European Space Agency, The Royal Netherlands Aerospace Centre, Massachusetts Institute of Technology, SEN Space TV, Lacuna Space, HyperActive consortium [174].

NanoAvionics revenue in 2019 was $0.8M, and $3.3M in 2020 [29], a YoY increase of 300%.

NanoAvionics helped AST build its BlueWalker-1 and 2 satellites, but its future role in the manufacturing of further AST satellites is uncertain. AST is working with NEC and Safran to manufacture their satellites, and also does a lot of the manufacturing in-house.

While the NanoAvionics stake owned by AST might have some strategic benefits (it’s helpful to have manufacturing expertise in-house and to keep tabs on the industry), AST was exploring the possibility of reducing its ownership interest in NanoAvionics already in January 2021 [29] and recently succeeded in the sale [33].

Competition

General comment on AST competitors

Telecommunications market is enormous ($1T) and AST plans to capture just 1%~ of it by 2027. [27]

There are currently no true direct competitors in commercial service at this time, and the market is large enough to support several competing companies even if that wasn’t the case. However, AST is the clear leader today (inc. commercial partnerships, funding, technology and patents).

Lynk is possibly the most similar company to AST because it also targets the cellular market. It seems to be behind AST by several years in terms of development, though, and received much less funding to date.

The most recent (announced on August 25, 2022) new competitor is T-Mobile in Starlink partnership [3], which will initially target low-data services, such as emergency messaging and calls. They aim for commercial service by late 2023, same as AST.

One common misconception is thinking that Starlink's existing flagship internet broadband service is already directly competing with AST. However, Starlink currently doesn’t provide mobile phone services – its customers need a satellite dish and other hardware in their homes.

It is true that Starlink's + T-Mobile's upcoming direct-to-mobile service will compete with AST. We will talk about this in detail later in the Starlink section.

Here’s a useful comparison of some LEO mega constellation projects (showing only the existing Starlink's broadband offering and not yet reflecting the newly announced T-Mobile service)[175]:

| AST SpaceMobile ($ASTS) | Starlink by SpaceX (Private) | OneWeb (Private) | Kuiper by Amazon ($AMZN) | LightSpeed (Private) | |

|---|---|---|---|---|---|

| Target Markets | Cellular Broadband | Residential Broadband, Mobility | Residential Broadband, Mobility, IOT, Backhaul, PNT | Residential Broadband, Mobility, IOT, Backhaul | Mobility, IOT, Backhaul |

| User Hardware | Existing Cell Phone | Antenna Terminal | Antenna Terminal | Antenna Terminal | Antenna Terminal |

| Hardware Cost to User | $0 | $599 | $200-$300 | No Estimates | No Estimates |

| Speed / Latency | >35 Mbps / <30 ms | ~100 Mbps / <30 ms (200 Mbps peak) | ~200 Mbps / <32 ms (400 Mbps peak) | "up to 400 Mbps" / Likely ~30 ms | "up to 7.5 Gbps / Likely ~30 ms |

| Primary Go-to-Market Strategy | Super Wholesaler to Telcos | Direct to Consumer | Direct to Consumer | Direct to Consumer | Direct to Enterprise |

| Distribution Partners | Vodafone, AT&T, Rakuten, Telefonica, Telestra, Indosat, Telecom Argentina, Tigo, Liberty LatAm | NA | AST Group, Hughes, TrustComm, Pacific Dataport | NA | NA |

| Spectrum for User Communications Propagation = Lower is Better Throughput = Higher is Better | Wireless Carrier Low Band (700-950 MHz) Midband (1.7-2.2 GHz) C Band (3.7-4.2 GHz) | V and Ku Bands (10.7-12.7 GHz) (37.5-42.5 GHz) | Ku and Ka Bands (20-40 GHz) | Ka Band (17.7-18.6 Ghz) (18.8-20.2 Ghz) (27.5-30.0 Ghz) | Telesat "Priority" Ka Band (26-40 GHz) |

| Satellites Planned | 340 | 12,000 | 648 | 3,236 | 298 |

| Capex | $3.3B | >10B | <6B | $10B | $5B |

| Commercial Service (Est) | 2023 | 2021 | 2022 | Before 2025 | 2023 |

| Complete Launch Date | 2028 | 2029 | 2022 | 2029 | 2023 |